The UK capital values show surprise growth in March

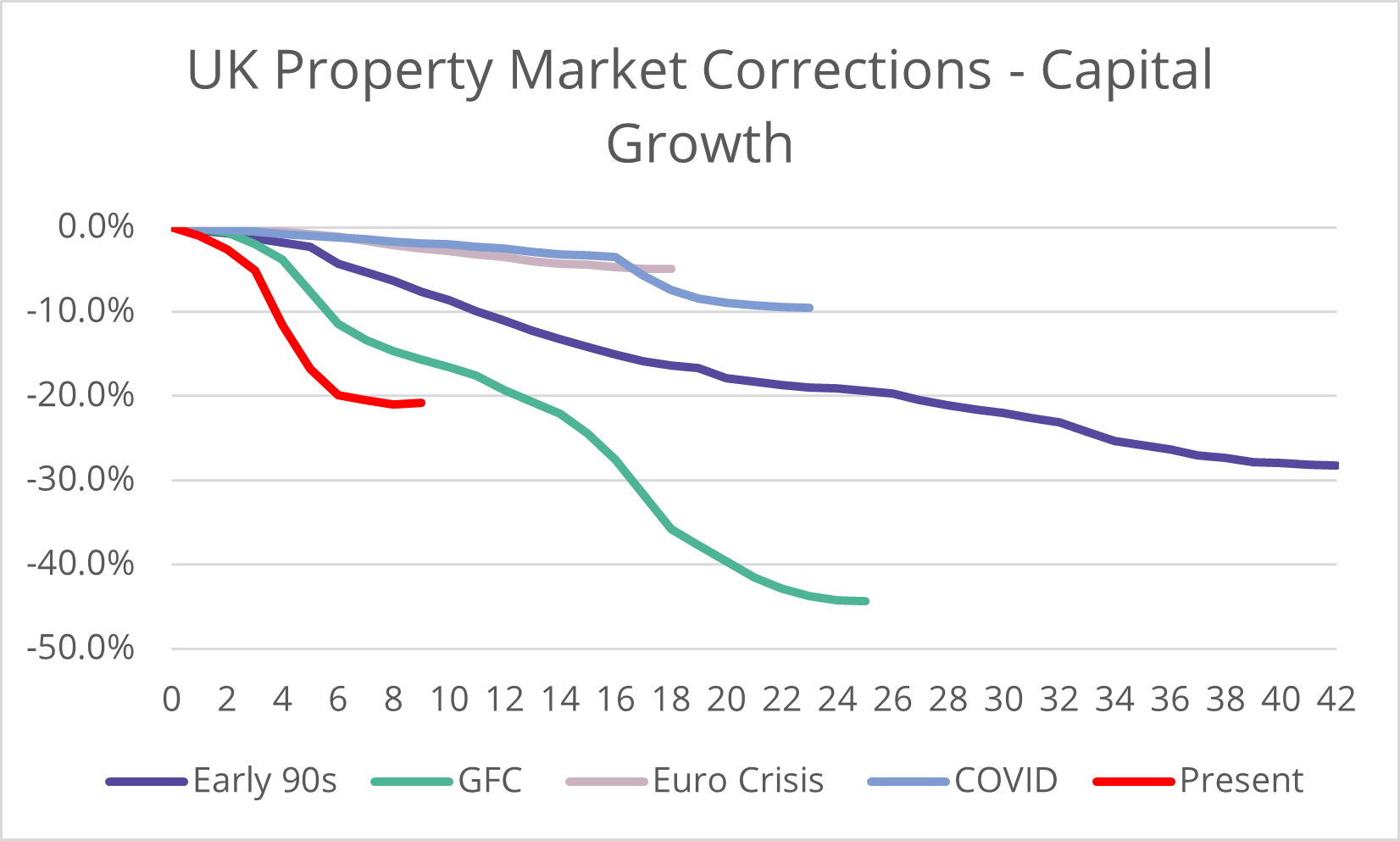

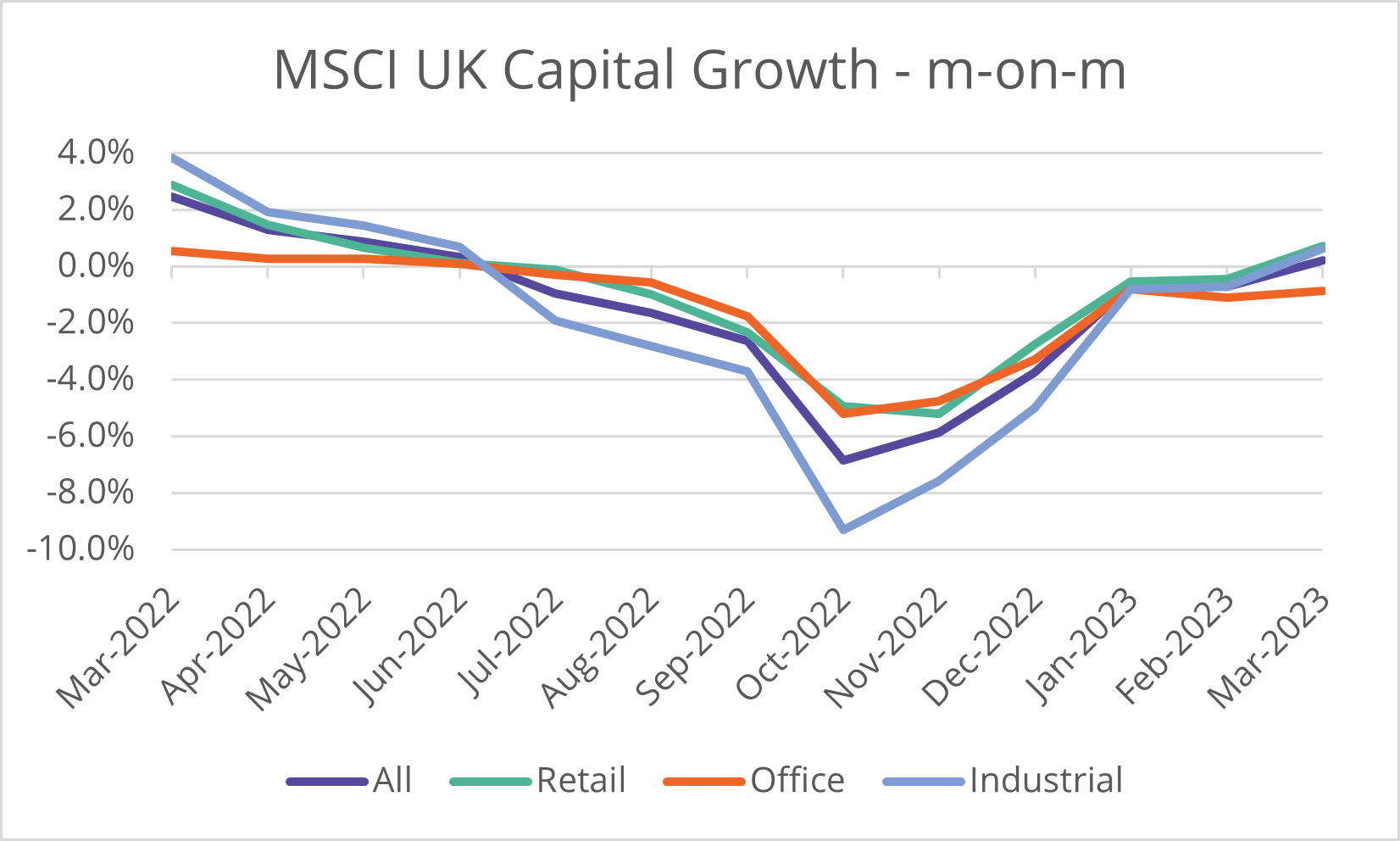

The figures for March 2023 from the MSCI UK monthly index for commercial property proved to be better than expected, with the all property capital growth index reporting a small month-on-month rise of 0.2%. This was the first increase since June 2022, with the intervening months having seen the fastest decline in property values of any UK property market correction since the benchmark index was created in 1986.

Source: MSCI

March was a month of subdued sentiment in the property market, due to uncertainty over the strength of the economy and future direction of interest rates, as well as a general expectation the market correction for real estate had further to run. There was also volatility in the financial markets due to a number of bank failures, which in turn created additional nervousness on the outlook for debt availability. To this backdrop, an increase for capital values at the MSCI all property level is a surprise. We doubt this marks the exact turning point for the market cycle, as the fallout from bank failures and fast changing expectations on interest rates will take time to filter through to the property market. However, it is encouraging that we are starting to see the price correction encountering this first sign of hitting a resistance level.

Source: MSCI

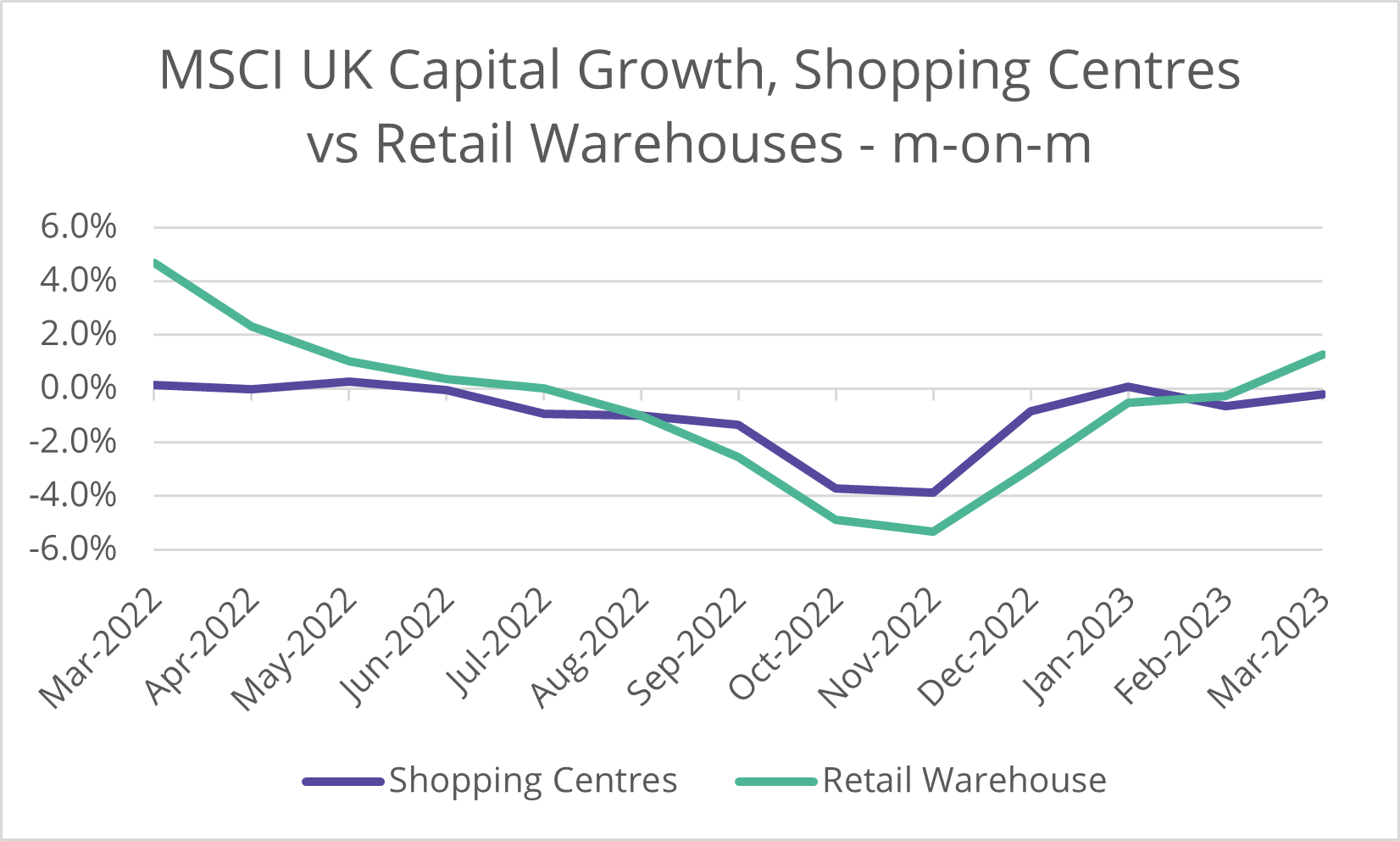

Unsurprisingly, the return to growth is not universally true across the sectors and sub-sectors. Retail saw the strongest growth in March (0.7% m-on-m), although this was entirely due to a 1.2% increase for retail warehouses, which outweighed further falls for shopping centres and standard shops. In contrast, offices continued to decline at the sector level (-0.9%), but the Midtown & West End and Rest of the UK sub-sectors achieved marginal growth (0.1% each). The picture for industrial property was more consistent, with all the main geographic sub-sectors recording some growth. The best performance was seen in Eastern England (1.5%) and Outer South East (just under 1.0%).

Since peaking in June 2022, the all property capital growth index is down -20.8% cumulatively, with industrial as the worst performing of the main three sectors (-27.5%). However, in this latest downturn we have observed faster corrections in the sectors and sub-sectors that are more of interest to potential buyers, suggesting a realistic prospect of selling is persuading vendors to lower the price. Consequently, there is probably greater transparency in markets like industrial and retail warehouses than perhaps shopping centres, which are seeing very reduced sales volumes resulting in less clarity on pricing.

Source: MSCI

Turning to what is driving the rise in capital values, there is sector variation. For retail, there is more pressure from yield impact (0.9% m-on-m) than rental growth (a marginal 0.04%). That retail yield shift is coming overwhelmingly from retail warehouses. For industrial, the yield impact is less significant (0.1%) with rental growth playing a bigger role (0.7%). So, we are not seeing much ‘weight of money’ capital growth, other than in retail warehouses.

It is now apparent that September to December 2022 marked the darkest hour of the correction, after which the pace of decline for values decelerated sharply in January and February, then turned marginally positive in February. The question is: do the March figures mark the inflection point for values, or a brief dip up to the surface, followed by further negative readings?

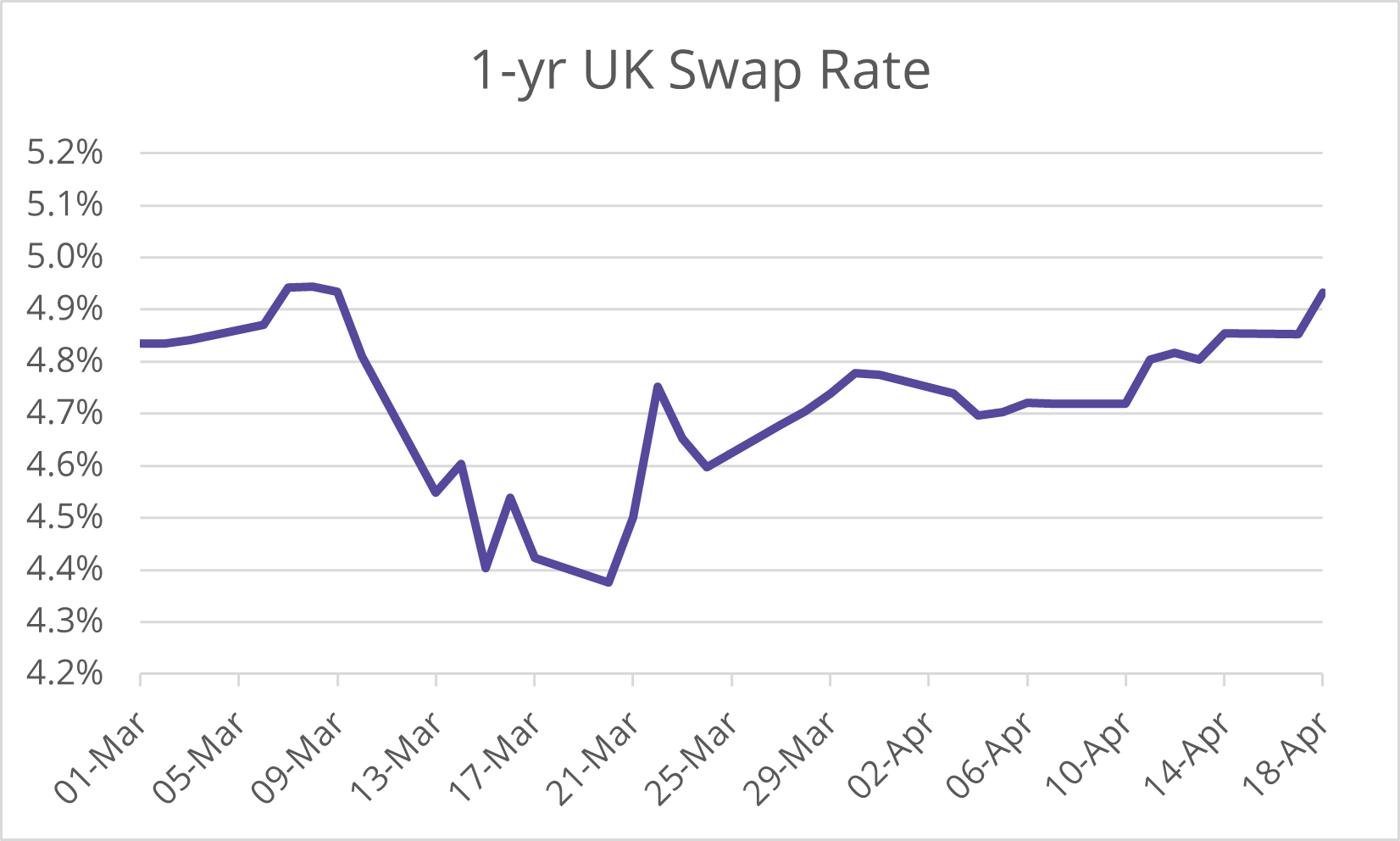

We believe that while the bank runs of March / April have not proved severe enough to seriously destabilise either the economy or the financial markets, they have caused a sufficient amount of volatility and uncertainty to keep investors in ‘wait-and-see’ mode for a few more months. For instance, the outlook for interest rates remains clouded, with an ongoing debate on whether additional base rate hikes are in the pipeline. The chart below illustrates the sharp movements seen for interest rate swaps witnessed since early March. This has led to rising concerns that some building owners will be unable to refinance assets, leading to forced sales.

Source: Macrobond

To set against these negative pressures, the economic news has been better-than-expected lately. UK GDP achieved a surprise modest increase in Q4 2022, and many commentators (including the Office for Budget Responsibility) are expecting the economy to avoid a technical recession in 2023. The UK unemployment rate has only seen a marginal increase in the last year despite a steep rise in interest rates. Moreover, recent PMI data points to increased business activity in the key services sector, which accounts for over 80% of UK GDP.

Given this mix of uncertainty, financial market volatility and a modest improvement in the macro-economic backdrop, we see property capital values staying close to the zero mark this spring, alternating between negative and positive readings each month. A broad-based turning point for property will require greater clarity on interest rates, more stock coming to the market and the prospect of stronger economic growth on the horizon. This environment we believe will emerge from Q3 onwards, leading us to forecast a H2 recovery for the wider commercial property market, probably with a rise in demand for trophy / core prime assets from late spring onwards.