The MSCI January Index – Cat Amongst the Pigeons

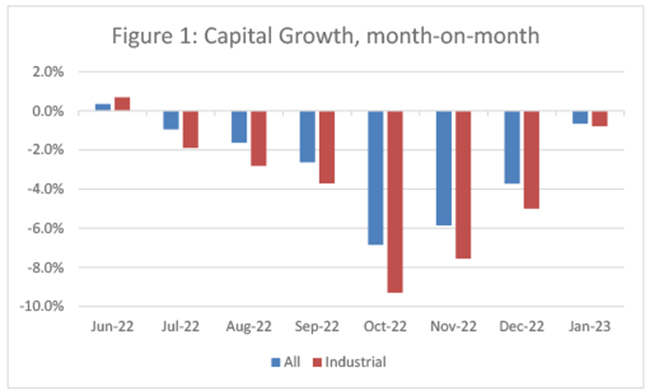

The January 2023 MSCI (IPD) UK Monthly Index reported a surprisingly low fall in all property capital growth of -0.7% month-on-month, up from -3.7% in December. This was the lowest month-on-month decline we have seen since values peaked in June 2022.

The worst month so far in this downturn for all property capital growth was October 2022, which recorded a drop of -6.9%. The falls have steadily decelerated in pace since – see figure one. However, the January 2023 figure marks an abrupt change in the rate of decline. Another surprise in the Monthly Index was found in the office equivalent yields data, which saw a marginal hardening from 7.37% to 7.35%.

Source: MSCI UK Monthly Index

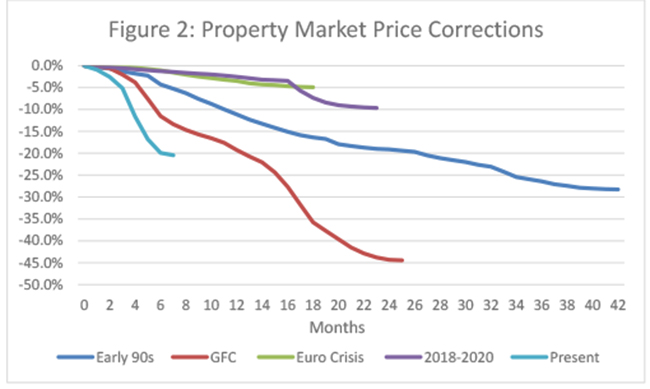

This prompts two immediate responses. Firstly, this is one month’s data during a time of market uncertainty, so we will need to see more evidence (including from other sources) to establish whether January was a just blip. Second, we have in recent months seen the fastest fall in capital growth of any downturn since the Monthly Index began in 1986 – see figure two. So, it is possible that a lot of the repricing has now occurred, and in the absence of any additional reason to be concerned about values, there is a path ahead to stabilisation.

Source: MSCI UK Monthly Index

Why has the market corrected so quickly this time? Anecdotally, there is significant ‘dry powder’ on the side lines waiting to re-enter the market when the time is right. So, the prospect that deals could be done, just not at the old prices, is a powerful incentive for vendors to mark down values. Indeed, we believe the -20.5% fall in value that has occurred since June 2022 will prompt some opportunist buyers to begin due diligence and market research ahead of transacting deals in the spring or summer. This could be particularly the case for industrial investment, given it has seen greater price falls than offices and retail. Also, parts of the logistics occupier market are still seeing a mismatch between supply and demand.

The day after the release of the MSCI index saw the reporting of another fall in UK CPI inflation, including on the core measure. This increases the likelihood the Bank of England base rate has now reached a peak, providing a more stable environment for those raising property debt in 2023. That also improves the odds property market pricing may be drawing closer to a turning point.

There is also the possibility of a correction in two phases for property. Our conversations with those considering re-entering the market point to a preference for large, dry assets with strong ESG credentials. Therefore, it is possible that the falls we have seen in the index are mainly being driven by prime assets; while for parts of the secondary market a lack of transactional evidence means that values are still in the early stages of correction. This could result in a second phase of softening for the index later this year, or early in 2023, as transaction volumes pick-up for lesser quality stock.

As mentioned above, we always caution against reading too much into one month’s data. It should also be emphasised that values are still falling, just at a much slower pace. Nevertheless, the January MSCI Monthly Index figures have put a cat amongst the pigeons in the debate on how close we are to the turning point for the property investment market cycle. More evidence is needed, but there is now reason for opportunist buyers to be looking more closely at the market in preparation for perhaps deploying funds in the coming months.

For more information, please contact: